A Definitive Guide to Calculating How Much Life Insurance to Buy

Life insurance is one of the most crucial financial safeguards you can put in place, transforming an unthinkable tragedy into a manageable financial situation for your loved ones. However, the most common question—and the most difficult to answer—is: “How much life insurance do I actually need?” The answer is intensely personal, dependent not on generalized advice, but on a precise calculation of your unique financial obligations, future income replacement needs, and long-term family goals. Buying too little leaves your family vulnerable, while buying too much wastes premium dollars. This article provides a definitive, step-by-step guide to calculating the right amount of coverage to secure your family’s future.

Step 1: The DIME Method—A Simple Starting Point

A popular and helpful mnemonic for calculating insurance needs is the DIME method, which addresses the most immediate and critical financial obligations a family would face.

- D for Debt: Calculate all outstanding debts that you

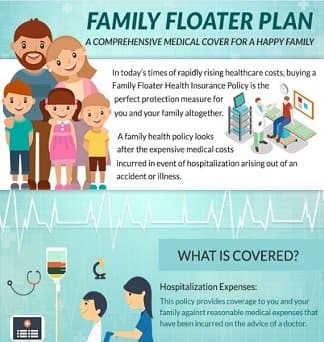

Health insurance is a sort of insurance where the insurer pays for the medical expenses of the insured when the insured turns into sick as a consequence of illness or damage. Today, there are a number of types of medical health insurance to select from. Individual medical health insurance, group well being, employee?s compensation, and government health plans similar to Medicare and Medicaid are a number of the various kinds of medical health insurance plans.

Health insurance is a sort of insurance where the insurer pays for the medical expenses of the insured when the insured turns into sick as a consequence of illness or damage. Today, there are a number of types of medical health insurance to select from. Individual medical health insurance, group well being, employee?s compensation, and government health plans similar to Medicare and Medicaid are a number of the various kinds of medical health insurance plans. If you’re coated by statutory well being insurance coverage from one of the above countries you are exempt from the requirement to acquire German health insurance. However, you need to present your European Health Insurance Card (EHIC), type E128 or kind A/T 11 (Turkish residents) to the AOK office in Passau (see under for handle). You will then be issued a health insurance card, which you need to current whenever you go to see a physician.

If you’re coated by statutory well being insurance coverage from one of the above countries you are exempt from the requirement to acquire German health insurance. However, you need to present your European Health Insurance Card (EHIC), type E128 or kind A/T 11 (Turkish residents) to the AOK office in Passau (see under for handle). You will then be issued a health insurance card, which you need to current whenever you go to see a physician.